Seller Concessions: A Smart Strategy To Get Your House Sold

Seller Concessions: A Smart Strategy To Get Your House Sold

BLOGFebruary 20, 2025

For SellersInventorySelling Tips

3 min read

For the past few years, it’s been mostly a seller’s market. But dynamics are shifting as the number of homes for sale grows. And that means that the market is balancing out a bit. As a result, some sellers are finding they need to be more flexible to close a deal. One strategy that can help? Offering concessions.

As the National Association of Realtors (NAR) explains:

“As home inventory begins to grow and buyers regain some advantage in the market, sellers may consider offering more in negotiations to make the deal more attractive and get to the closing table.”

What Are Seller Concessions?

Concessions are homebuying costs that a seller agrees to cover as a way to get their house sold. And based on data from the National Association of Realtors (NAR), nearly 1 out of every 4 sellers (24%) offered a concession in 2024. Here are a few of the most common types of concessions:

- Covering Closing Costs: The seller pays for part (or all) of the buyer’s closing costs, like appraisal fees, title insurance, or loan fees.

- Price Adjustments: Instead of making repairs, a seller might lower the purchase price to make up for updates the buyer will need to tackle.

- Adding a Home Warranty: A seller may throw in a home warranty, giving the buyer peace of mind key repairs will be covered in the first year.

And don’t worry. This doesn’t mean you have to come up with more cash to make it happen. These are things that get subtracted from your profits at closing – not more funds you have to bring to the table. And not all concessions are about money.

There are other extras you could throw in. Like, if your buyer is coming from an apartment and has never had a yard before, they may ask if you’d be willing to leave your lawn mower behind. That’s another lever you could pull to keep them happy.

How Concessions Help Sellers

Offering concessions can be a smart strategy for sellers to get a deal done. As Dennis Shirshikov, Professor of Finance and Economics, City University of New York/Queens College told The Mortgage Reports:

“Pricing homes realistically and being willing to offer concessions, such as covering a portion of closing costs or including upgrades, will be key to closing deals . . . in a less frenzied market.”

For example, let’s say you accepted an offer from a buyer, but after their inspection, you found out there are some repairs they want you to tackle before you hand over the keys.

Rather than starting at square one and searching for a new buyer, you could offer a concession. One option is you can take on the repairs and cover the costs yourself. But, if you really don’t want the hassle of dealing with contractors, you could reduce your price by however much repairs would cost. Alternatively, you could offer to pay a portion of your buyer’s closing expenses with the idea they’d use the money they saved at closing toward doing the repairs themselves.

Either way, a concession can be a great way to meet in the middle. However, it’s important to have an agent on your side to help with these negotiations.

A good real estate agent can help you decide when and how to offer concessions, so you don’t give away too much while still ensuring your house gets sold. It’s all about finding the right balance.

Bottom Line

With the market becoming more balanced, seller concessions are coming back into play in some areas. The key is having an agent to help guide you through the process, so things work out in your favor. That’s where I come in.

What’s a concession you’d consider to move things along?

The Return to Urban Living – Why More People Are Moving Back to Cities

The Return to Urban Living — Why More People Are Moving Back to Cities

BLOGFebruary 19, 2025

3 min read

After years of suburban and rural migration during the pandemic, cities have been making a comeback in the past couple of years. According to the National Association of Realtors (NAR), the percentage of people moving to cities has risen to 16%. While that may not sound like a big number to you, it is the highest level in a decade – and that’s a big deal (see graph below):

And data from BrightMLS seems to confirm this trend. In a recent survey, 1 in 5 (20.6%) people looking to buy say they want to live in the city.

So, what’s behind this ongoing shift back to urban living? Let’s break down the top three reasons why people are trading quiet suburbs for bustling cityscapes. You may find out you want to sell your house with a big yard and move to an urban oasis, too.

1. Vibrant Culture

Cities have always been hubs of culture, entertainment, and community. They’re packed with energy and there are always endless things to do. During the pandemic, a lot of that excitement was put on pause. But the last couple of years? Cities are buzzing again.

There’s nothing quite like being able to walk to your favorite coffee shop, pop into a local gallery, see a live concert or show, or grab a last-minute dinner at a great spot down the street. It’s a lifestyle that’s easy to love — and one a lot of people want today.

2. Being Close to Work

Remote work is still a thing, but most companies are moving to hybrid schedules or even bringing employees back to the office. That makes living closer to work way more convenient. Whether it’s cutting down a long commute or having more chances to network in person, being close to the office is a big plus — especially for industries that thrive on face-to-face connections.

3. Easy Access To Everything You Need or Want

One of the best things about living in a city? The convenience. Public transportation, top-notch healthcare, and so much more are all within easy reach. For a lot of people, having everything nearby just makes life easier — and it’s a big reason they’re drawn to urban living.

What To Do If You Want To Move To the City

Let’s say you moved to a suburban area during the pandemic and you’re missing the excitement of living right off city streets. You’re probably thinking: how can I afford to move back into the heart of things with how mortgage rates and home prices are? Here’s how other people are doing it.

According to data from the Federal Housing Finance Agency (FHFA), home values have gone up by 57.4% in the last 5 years alone. And that means your house is probably going to sell for more than you bought it for.

If you already own a home in the suburbs, you may be able to sell that house and use the equity you get back to fuel your move. Sure, you may have to compromise and be happy with a smaller, urban space – but if it’s the lifestyle you’re craving – that trade-off is going to be worth it. To find out what’s possible and what it costs to live in an urban area, lean on a local real estate professional.

Bottom Line

The urban renaissance is real. Whether it’s the vibrant culture, being close to work, or having easy access to everything you need, cities are once again calling — and people are answering.

What’s your favorite thing about life in the city? Let me know.

I’d love to find you a home you love where all the hustle and bustle makes life a bit more exciting.

Buying a Home May Help Shield You from Inflation

Buying a Home May Help Shield You from Inflation

BLOGFebruary 18, 2025

2 min read

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected – and that’s impacting the costs of goods, services, and more. And with rising costs all around you, you’re probably questioning: is now really the right time to buy a home?

Here’s the good news. Owning a home is actually one of the best ways to protect yourself from the rising costs that come with inflation.

A Fixed Mortgage Protects You from Rising Housing Costs

One of the key benefits of homeownership is that when you buy a home with a fixed-rate mortgage, your biggest monthly expense — your mortgage payment — stabilizes. Sure, your payment could rise slightly as your homeowner’s insurance and property taxes shift. But no matter what happens with inflation, your principal and interest payments won’t change.

That’s not the case if you rent. Rent tends to rise over time, and it usually goes up even faster than the rate of inflation. Just look at the data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

So, while renters face higher costs year after year, homeowners with a fixed mortgage rate lock in their monthly payments, making it easier to budget no matter what happens with inflation.

Home Prices Typically Rise Faster Than Inflation

Another big reason homeownership is a great hedge against inflation is that home values tend to appreciate over time — often at a higher rate than inflation, according to data from the BEA and Fannie Mae (see graph below):

That makes real estate one of the strongest long-term investments during times of rising prices. While inflation can chip away at the value of cash savings, real estate typically holds or grows in value, allowing you to build wealth.

On the other hand, renting offers no protection against inflation. In fact, it does the opposite — when inflation drives up costs, landlords often pass those increases onto tenants through higher rents.

That means as a renter, you’re continually paying more without gaining any financial benefit. But as a homeowner, rising prices work in your favor by increasing the value of your home and growing your equity over time.

And with experts forecasting continued home price growth, that means you’re making an investment that usually grows in value and should outperform inflation in the years ahead.

In short, a fixed-rate mortgage protects your budget, and home price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.

Bottom Line

Inflation can make everyday expenses unpredictable, but owning a home gives you stability. Unlike rent, your monthly mortgage payment stays pretty much the same over time. Plus, the value of your home is likely to increase after you buy.

How would having a fixed housing payment change the way you budget for the future?

Are You Asking Yourself These Questions About Selling Your House?

Are You Asking Yourself These Questions About Selling Your House?

BLOGFebruary 17, 2025

3 min read

Some homeowners hesitate to sell because they’ve got unanswered questions that hold them back. But a lot of times their concerns are based on misconceptions, not facts. And if they’d just talk to an agent about it, they’d see these doubts aren’t necessarily a hurdle at all.

If uncertainty is keeping you from making a move, it’s time to get the real answers. The ones you deserve. And to take the pressure off, you don’t have to ask the questions, because here’s the data that answers them.

1. Is It Even a Good Idea To Move Right Now?

If you own a home already, you may be tempted to wait because you don’t want to sell and take on a higher mortgage rate on your next house. But your move may be a lot more feasible than you think, and that’s because of how much your house has likely grown in value.

Think about it. Do you know anyone in your neighborhood who’s sold their house recently? If so, did you hear what it sold for? With how much home values have gone up in recent years, the number may surprise you. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), the typical homeowner has gained $147,000 in housing wealth in the last five years alone.

That’s significant – and when you sell, that can give you what you need to fund your next move.

2. Will I Be Able To Find a Home I Like?

If this is on your mind, it’s probably because you remember just how hard it was to find a home over the past few years. But in today’s market, it isn’t as challenging.

Data from Realtor.com shows how much inventory has increased – it’s up nearly 25% compared to this time last year (see graph below):

Even though inventory is still below more normal pre-pandemic levels, it’s improved a lot in the past year. And the best part is, experts say it’ll grow another 10 to 15% this year. That means you have more options for your move – and the best chance in years to find a home you love.

3. Are Buyers Still Buying?

And last, if you’re worried no one’s buying with rates and prices where they are right now, here’s some perspective that can help. While there weren’t as many home sales last year as there’d be in a normal market, roughly 4.24 million homes still sold (not including new construction), according to the National Association of Realtors (NAR). And the expectation is that number will rise in 2025. But even if we only match how many homes sold last year, here’s what that looks like.

- 4.24 million homes ÷ 365 days in a year = 11,616 homes sell each day

- 11,616 homes ÷ 24 hours in a day = 484 homes sell per hour

- 484 homes ÷ 60 minutes = 8 homes sell every minute

Think about that. Just in the time it took you to read this, 8 homes sold. Let this reassure you – the market isn’t at a standstill. Every day, thousands of people buy, and they’re looking for homes like yours.

Bottom Line

When you’re ready to walk through what’s on your mind, I have the answers you need. And in the meantime, tell me: what’s holding you back from making your move?

Why You’ll Love Owning a Home

The Secret To Selling This Spring: Start the Prep Work Now

The Secret To Selling This Spring: Start the Prep Work Now

BLOGFebruary 13, 2025

3 min read

Spring is the busiest season in the housing market. It’s the time of year when buyers are most active – that means it’s when homes sell faster and for top dollar. If you’ve already got a move on your mind, why not list this spring and take advantage of the added buyer demand?

Since spring is just around the corner, now’s the time to start getting your house market-ready. You’ve got just over a month to do the prep work. And while that may sound like a decent amount of time, it’s going to go by quickly. And you won’t want to rush through this important task – especially this year.

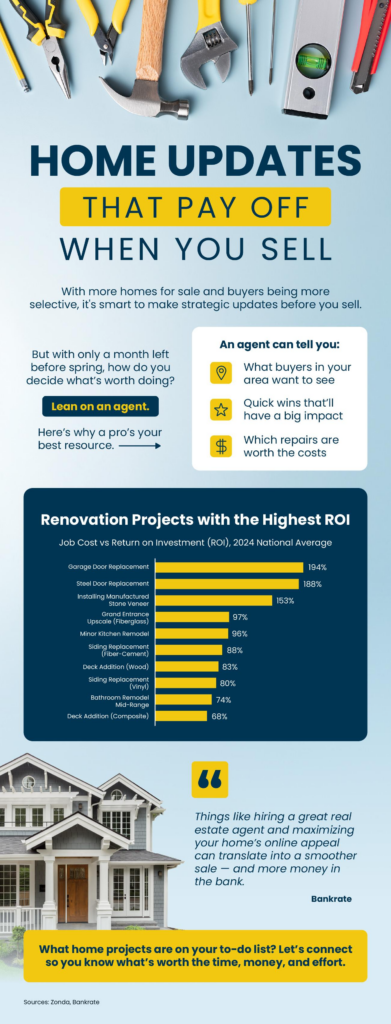

The Right Repairs Will Matter More This Spring

Right now, two things are true. There are more homes on the market than there have been in years. And buyers are being extra selective. That combination means you need to invest some time and effort in making strategic repairs. And many homeowners already have a jump on this work.

In the 2025 Outlook for Home Remodeling, Carlos Martin, Director of the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, explains:

“. . . homeowners are slowly but surely expanding the pace and scope of projects compared to the last couple years.”

And the most common projects they’re tackling are replacing water heaters, HVAC units, and flooring. Energy efficiency is a key consideration too, based on home improvement data from the Census.

What To Prioritize as You Plan Ahead

But just because that’s what other homeowners are doing, it doesn’t mean that’s what you have to tackle. Think about what you’d want to see if you were a buyer. Focus on quick wins that are easy to knock out with the time you have – but, don’t ignore key repairs, especially ones you think could turn off buyers.

While big-ticket items like replacing an old roof or outdated flooring may seem daunting, they can pay off – especially if you focus on projects with the best return on investment (ROI).

An agent’s expertise is key in narrowing down your list to what’s actually worth it. They know what buyers in your area want and they also have data like this report from Zonda to guide you on which updates have the best ROI (see green in the graph below):

That’s why it’s so important to talk to a local real estate agent before you dive into any repairs. Bankrate puts it best:

“As a seller, it’s smart to be prepared and control whatever factors you’re able to. Things like hiring a great real estate agent and maximizing your home’s online appeal can translate into a smoother sale — and more money in the bank.”

It’s not too early to partner with an agent. By starting now, you’ve still got time to space out the work and find any contractors you need to get the job done. If you wait until spring to roll up your sleeves, you risk running out of time – and that means your house may be overshadowed by others who are more buyer-ready.

Bottom Line

If you’re planning to sell this spring, it’s time to start tackling your to-do list. But, before you get started, let’s connect. That way you can make sure you’re spending your time and budget on projects that’ll pay off in the long run.

Send me a list of what’s on your to-do list, and we can prioritize them together.

Breaking Into the Market: Smart Moves for First-Time Buyers

Breaking Into the Market: Smart Moves for First-Time Buyers

BLOGFebruary 12, 2025

For BuyersFirst-Time BuyersBuying Tips

2 min read

If you’re like a lot of aspiring homebuyers, there’s a major hurdle standing in your way — the cost of living. From groceries to gas, eggs, and just about everything else, prices have gone up. And that rings true for home prices, too.

But even when everything feels expensive, there are still ways to make homeownership more than an item on your wish list. You may just need to think about where you plan to buy a bit differently.

Think of Your First Home as a Stepping Stone

One of the biggest misconceptions among buyers is that their first home has to be their forever home – or that it has to check all the boxes of what they want right out of the gate. In reality, it’s just a starting point.

Once you own a home, you start to build equity, which grows over time as home prices rise. Down the road, if you want to move — whether to a larger space, a better location, or both — the equity you’ve gained can help you do just that.

So rather than waiting until you can afford your dream home in your ideal neighborhood, consider starting with something that works for now.

Expand Your Search To Find More Affordable Options

If high home prices in your favorite area are holding you back, it’s time to cast a wider net. By keeping an open mind and being flexible with location, you may be surprised at what’s possible within your budget. Many buyers find success by looking in surrounding areas – and some even choose to move out of state.

According to a report from Realtor.com, these are some of the best markets for first-time homebuyers this year (see chart below):

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

If you want to stay local, looking just outside your preferred neighborhood could help you find something you can afford that’s still pretty close to your favorite restaurants, shops, and activities. Sometimes, moving as little as 10 minutes away makes a big difference.

And the best way to see what’s available is to work with a real estate agent who understands the local market and can help you identify hidden gems nearby. An agent can point you to communities you may not have considered that have lower price tags now and are steadily gaining value and appeal. That way you can buy your first home and be set up to gain equity through the years.

Bottom Line

Today’s cost of living is a challenge for many homebuyers. But by exploring different areas and working with a knowledgeable agent, you can take that first step toward owning a home — and building equity for your future.

How far outside of your area would you look to make homeownership happen? Let’s connect to chat through your options.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

BLOGFebruary 11, 2025

Less than one minute

This could be the year to sell your house – and here’s why. According to a recent NerdWallet survey, 15% of people are planning to buy a home this year. That’s actually a record high for this survey (see graph below):

Here’s why this is such a big deal. The percentage has been hovering between 9-11% since 2020. This recent increase shows buyer demand hasn’t disappeared – if anything, it indicates there’s pent-up demand ready to come back to the market.

That doesn’t mean the floodgates are opening and that there’s going to be a huge wave of buyers like we saw a few years ago. But this does signal there’ll be more activity this year than last.

At least some of the buyers who put their plans on hold over the past few years will jump back in. Whether they’re feeling more confident about moving, they’ve finally saved up enough to buy, or they simply can’t wait any longer – this is the year they’re aiming to take the plunge.

And, according to that same NerdWallet survey, more than half (54%) of those potential buyers have already started looking at homes online.

That’s a good indicator that a number of these buyers will be looking during the peak homebuying season this spring. So, if you find the right agent to make sure your house is prepped, priced, and marketed well, you can get your house in front of them.

Bottom Line

More people are going to move this year, and with the right strategy, you can make sure your house is one of the first they look at.

What do you think these buyers will love most about your house?

Let’s talk it over and make sure it’s front and center in your listing.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

Home Price Growth Is Moderating – Here’s Why That’s Good for You

BLOGFebruary 10, 2025

2 min read

Over the past few years, home prices skyrocketed. That’s been frustrating for buyers, leaving many wondering if they’d ever get a shot at owning a home. But here’s some welcome news: that whirlwind pace of home price growth is slowing down.

Home Prices Are Rising at a Healthy Pace

At the national level, home prices are still going up, but at a much more moderate, normal pace. For example, in November, the year-over-year increase in home prices was just 3.8% nationally, according to Case-Shiller. That’s a far cry from the double-digit spikes that occurred in 2021 and 2022 (see graph below):

This more normal home price growth might make buying a home feel more attainable for many buyers. You won’t face the same sticker shock or rapid price jumps that made it hard to plan your purchase just a few years ago.

At the same time, steady growth means the home you buy today will likely appreciate in value over time.

Prices Vary from Market to Market

While the national story is one of moderate price growth, it’s important to remember that all real estate is local. Some markets are seeing stronger growth, while others are cooling off or even seeing slight declines. As Selma Hepp, Chief Economist at CoreLogic, notes:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest — remain in high demand and continue to see upward home price pressures.”

Meanwhile, other regions saw slight month-over-month declines in November, according to Federal Housing Finance Agency (FHFA) data (see graph below):

What does this mean for you? It’s crucial to understand what’s happening in your local market. A national average can’t tell the whole story. That’s where working with a local real estate agent can really help. They have the tools and expertise to give you the full picture of what’s happening in your area and how to plan for that in your move.

Bottom Line

Home prices are growing at a more manageable pace, and working with a local real estate agent can help you navigate the ups and downs of your specific market.

How have changing home prices impacted your plans to buy? Let’s talk about it.