Is the Housing Market Starting To Balance Out?

Is the Housing Market Starting To Balance Out?

BLOGMarch 13, 2025

2 min read

For years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things are starting to shift in many areas.

So, is the market finally balancing out? And does that mean buyers will have it a bit easier now? Here’s what you need to know.

What Makes It a Buyer’s Market or a Seller’s Market?

It all comes down to how many homes are for sale in an area compared to how many buyers want to buy there. That’s what ultimately determines who has the most leverage.

- A Seller’s Market is when there are more buyers than homes available, so sellers hold the power. This leads to rising prices, multiple offers, and homes selling quickly – often above the asking price – because there isn’t enough to go around.

- A Buyer’s Market is when there are more homes than buyers. In this case, the tables turn. Sellers may have to offer concessions and incentives, or negotiate more to get a deal done. That’s because buyers have more choices and can take their time making decisions.

You can see this play out over time using data from the National Association of Realtors (NAR) in the graph below:

Where the Market Stands Now

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years. And that’s thanks to how much inventory has grown lately. As Lance Lambert, Co-Founder of ResiClub, explains:

“Among the nation’s 200 largest metro area housing markets, 41 markets ended January 2025 with more active homes for sale than they had in pre-pandemic January 2019. These are the places where homebuyers will be able to find the most leverage or market balance in 2025.”

Here’s a look at some of the strongest seller’s markets and buyer’s markets today, according to that research:

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Clever strategies can make buying in a seller’s market easier – and vice versa. And that’s exactly why you need to hire a pro. A local real estate agent knows their market like the back of their hand. They’re super familiar with what the supply and demand balance looks like and how to help their clients get a deal done either way. So, as long as you have a skilled pro by your side, it doesn’t really matter if your town is on the list or not.

With their expertise, you’ll be able to plan ahead and buy (or sell) no matter what the market looks like.

Bottom Line

With inventory rising, the market may be starting to balance out – but it all depends on where you want to buy or sell.

Are you wondering if buyers or sellers have the upper hand in our area? Let’s connect so you can find out.

Buying Your First Home? It’s Okay To Feel Nervous

Buying Your First Home? It’s Okay To Feel Nervous

BLOGMarch 12, 2025

For BuyersFirst-Time BuyersBuying Tips

3 min read

Buying your first home is exciting, but let’s be real – it can also feel overwhelming. It’s a big step, and with that comes plenty of questions. Am I making the right decision? Can I really afford this right now? Will I be able to make ends meet if I have unexpected repairs? What if I lose my job?

Here’s the thing: every first-time homebuyer has these thoughts.

The homebuying process has always been a mix of excitement and nerves, and that’s completely normal. Here’s some information that can give you a bit of perspective, so you don’t have these concerns.

Focus on What You Can Control

Since homeownership is new to you, you’re probably feeling like it’s hard to know what to budget for. And that can be a bit scary. You’ll have the mortgage, home insurance, and maintenance to think about – maybe even lawn care or homeowner’s association (HOA) fees. It’s easy to let the dollar signs be overwhelming. As Zillow says:

“Buying a house is a big decision, and you might feel confused and indecisive as you assess your current financial situation and try to work through whether or not the timing is right. Making big life choices might come with some self-doubt, but crunching the numbers and thinking about what you want your life to look like will help guide you down the right path.”

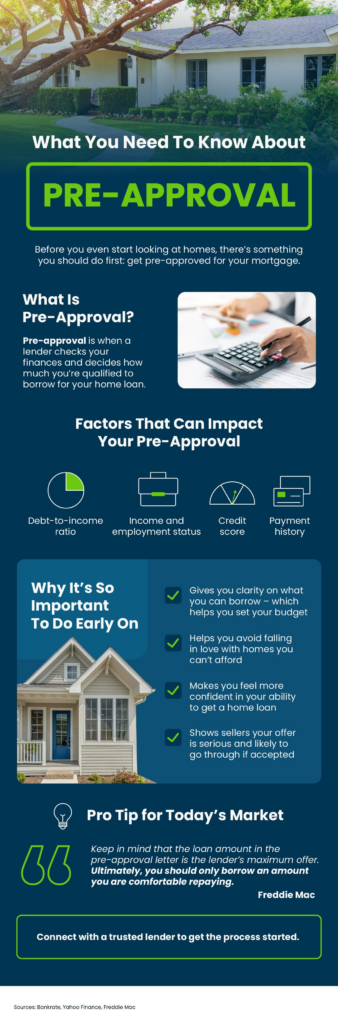

The important thing is to focus on what you can control. By partnering with a local agent and a trusted lender, you can get a clear understanding of what you can borrow for your home loan, what your monthly payment would be, and how your mortgage rate can impact it. And since that payment will likely be your biggest recurring expense, the key is to make sure the number works for you.

Don’t Stress About Repairs

The maintenance and repairs? Those can be a little bit harder to anticipate. But don’t forget you’ll get an inspection during the homebuying process to give you a better look at the condition of your future house. And with your inspection report in hand, you’ll have a good idea of what needs work. This way, you can start saving up so that you’re ready if and when something breaks.

But even then, if this is something that’s still really nagging at you, talk to your agent about asking the seller to throw in a home warranty. Those can cover repairs for some of the bigger systems in the house, like the HVAC, if they break within a specific time frame. While this isn’t a huge expense for the seller, the likelihood of a seller agreeing to one depends on what’s happening in your local market and how competitive it is right now.

It’s Okay To Stretch – Just Not Too Far

And remember, chances are that money will be a little tight – at least at first. And that’s kind of to be expected. A lot of times when someone buys their first home, they cut down on things like shopping and eating out for a while until they get a better idea of how their expenses will shake out in the new home.

But if you’re crunching the numbers and you won’t have enough money left for things like gas, food, etc. – it’s a sign you’d be stretching yourself too far. The last thing you want is to take on a payment that’s too much to handle. But stretching a little? That’s different. That’s normal.

Your Job Will Probably Change – And That’s Okay

And don’t forget, you’ll likely earn more down the road, so that slight stretch now won’t seem so bad as time wears on. As you advance in your career, you’ll probably start to make more money too. So, as your paycheck grows, the payments will get easier. Renting is a short-term option – and it’s one you deserve to get out of. Buying a home is a long-term play.

And just in case you’re worried about what happens if you do lose your job, you should know there are options, like forbearance, designed to help you temporarily pause payments on your home loan due to hardship.

Bottom Line

Buying your first home is a big decision, and it’s okay to feel a little nervous about it. But if you’re financially ready, don’t let fear keep you from moving forward. These emotions are normal, and great agents help their buyers get through them.

What makes you nervous when you think about buying your first home?

Let’s connect so you have an expert on your side to explain everything along the way.

Mortgage Rates Hit Lowest Point So Far This Year

Mortgage Rates Hit Lowest Point So Far This Year

BLOGMarch 11, 2025

2 min read

If you’ve been holding off on buying a home because of high mortgage rates, you might want to take another look at the market. That’s because mortgage rates have been trending down lately – and that gives you a chance to jump back in.

Mortgage rates have been declining for seven straight weeks now, according to data from Freddie Mac. And the average weekly rate is now at the lowest level so far this year (see graph below):

While that may not sound like a significant shift, it is noteworthy. Because the meaningful drop from over 7% to the mid-6’s can change your mindset when it comes to buying a home. Especially when the forecasts said we wouldn’t hit this number until roughly Q3 of this year (see graph below):

Why Are Rates Coming Down?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), recent economic uncertainty is playing a role in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

And the timing of this recent decline is great because it gives you a little bit of relief going into the spring market. Just remember, mortgage rates can be a quickly moving target, so you should expect some volatility going forward. But the window you have as they’re coming down right now might be the sweet spot for your purchasing power now.

What Lower Rates Mean for Your Buying Power

Even small changes in rates can make a difference to your monthly payment. Here’s how the math shakes out. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high), versus what it could look like if you buy a home now (see below):

In just a matter of weeks, the anticipated payment on a $400K loan has come down by over $100 per month. That’s a significant savings. When you’re making a decision as big as buying a home, every bit counts.

Just remember, shifts in the economy drove rates down faster than expected. But that can change, making rates volatile in the days and months ahead. So, if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity if you’re ready to act.

Bottom Line

Mortgage rates have dipped, giving buyers a bit more immediate breathing room. If you’ve been waiting for rates to ease before jumping in, this could be your window.

Would a lower monthly payment make buying a home feel more doable for you? Let’s break down the numbers and find out.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

BLOGMarch 10, 2025

For BuyersHome PricesFirst-Time BuyersBuying Tips

2 min read

At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly high and home prices going up, you may be holding out for prices to fall or trying to time the market for that perfect rate. But here’s the truth: waiting for the right moment could cost you in the long run.

Home Prices Are Still Rising – Just at a More Normal Pace

The idea that prices will drop dramatically is wishful thinking in most markets. According to the Home Price Expectations Survey from Fannie Mae, industry analysts are saying prices are projected to keep rising through at least 2029.

While we’re no longer seeing the steep spikes of previous years, experts project a steady and sustainable increase of around 3-4% per year, nationally. And the good news is, this is a much more normal pace – a welcome sign for hopeful buyers (see graph below):

What This Means for You

While it’s tempting to wait it out for prices or mortgage rates to decline before you buy, here’s what you’ll need to consider if you do.

- Tomorrow’s home prices will be higher than today’s. The longer you wait, the more that purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, rising home prices could still make waiting more expensive overall.

- Buying now means building equity sooner. Home values are rising, which means your investment starts growing as soon as you buy.

Let’s put real numbers into this equation. If you purchase a $400,000 home today, based on these price forecasts, it’s expected to go up in value by more than $83,000 over the next five years. That’s some serious money back in your pocket instead of being left on the sidelines (see graph below):

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Even though there are more homes for sale right now than there were at this time last year, or even last month, there still aren’t enough of them on the market for all the buyers who want to purchase them. And that puts continued upward pressure on prices. As Redfin puts it:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

While every market is different, most areas will continue to see moderate price growth. Some may level off a bit, but a major national drop? Not likely.

Bottom Line

Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Yes, today’s housing market has its challenges, but there are ways to make it work —exploring different neighborhoods, considering smaller condos or townhomes, asking your lender about alternative financing, or tapping into down payment assistance programs. The key is making a move when it makes sense for you rather than waiting for a perfect scenario that may never arrive.

Want to take a look at what’s happening with prices in our local market? Whether you’re ready to buy now or just exploring your options, having a plan in place can set you up for success.

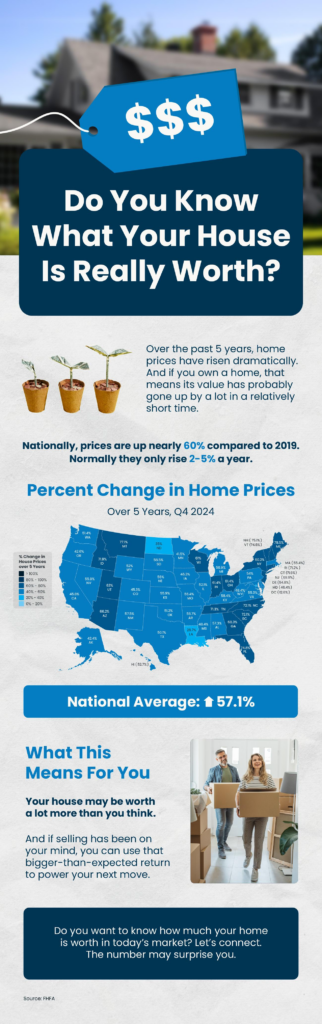

Do You Know What Your House Is Really Worth?

Headed Back Into the Office? You May Decide To Move

Headed Back Into the Office? You May Decide To Move

BLOGMarch 6, 2025

2 min read

It’s no secret that remote work has surged over the last few years. And that flexibility gave a lot of people the freedom to move — and work — from wherever they wanted.

But now, a growing number of companies are requiring employees to return to the office. And that’s leading some people to make decisions about where they live and if they need to move.

How Return-to-Work Policies Are Impacting Housing

During the rise of remote work, a lot of employees took the opportunity to move away from expensive or crowded city centers. Some opted for suburban neighborhoods and larger homes with yards, while others relocated to more rural areas. But lately, more people are returning to the city.

And according to data from Bright MLS, more than half of workers surveyed would have to rethink where they live or deal with long drive times if their job enforced a return-to-office policy (see chart below):

And maybe you’re one of them. If you moved farther out of the city during the work-from-home era, you may be facing a longer commute that you never expected to make daily. Once you’ve done it a few times, you might find it’s something you can get used to and isn’t as bad as you may have thought.

But sometimes, it’s just too hard to make it work — no matter how much you try. A drive or train ride that seemed fine once or twice a week can feel like too much of a grind five days in a row. It may also cost too much to commute so often, take too long, or cut too far into your free time. As Lisa Sturtevant, Chief Economist at Bright MLS, notes:

“During the pandemic, when remote work became the norm, homebuyers were able to move farther out . . . But workers do not have the same flexibility that they used to, and some are going to have to make a tough choice if and when their employer calls them back into the office full-time.”

If you’re thinking you may want to move, don’t stress. Talking to an agent can help you weigh your options. Whether it’s finding a home closer to work, balancing commute time with affordability, or even selling a home in one area to buy in another, having a pro on your side makes the process easier.

Bottom Line

If having to be back in-office has you considering a move, let’s connect. That way you have an agent to help you figure out what’s possible and what makes sense for you.

Where do you see yourself living if your commute or work routine needs to change?

Why a Pre-Listing Inspection May Be Worth It in Today’s Market

Why a Pre-Listing Inspection May Be Worth It in Today’s Market

BLOGMarch 5, 2025

3 min read

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection. That’s why it pays to anticipate potential issues before buyers ever step through the door. And one way to do that is with a pre-listing inspection.

What Is a Pre-Listing Inspection?

A pre-listing inspection is essentially a professional home inspection you schedule before putting your house on the market. Just like the inspections your buyer will do after making an offer, this process identifies any issues with the condition of your house that could have an impact on the sale – like structural problems, faulty or outdated HVAC systems, or other essential repairs.

While it’s a great option if you’re someone who really doesn’t like surprises, Bankrate explains this may not make sense for all sellers:

“While it can be beneficial for a seller to do, a pre-listing inspection isn’t always necessary. For example, if your home is relatively new and you’ve been the only owner, you’re most likely already aware of any big issues that could impact a sale. But for an older home, a pre-listing inspection can be very insightful and help you get ahead of any potential problems.”

The key is deciding whether the benefits outweigh the costs for your situation. Sometimes a few hundred dollars now can get you information that’ll save you a lot of time and hassle later on.

Why It May Be Worth Considering in Today’s Market

Right now, buyers are more cautious about how much money they’re spending. And they want to be sure the home they’re buying is worth the expense. In a market like this, a pre-listing inspection can be your secret weapon to make sure your house shows well. Here are just a few ways it can help:

- Gives You Time To Make Repairs: When you know about issues ahead of time, it gives you the chance to fix them on your schedule, rather than rushing to make repairs when you’re under contract.

- Avoid Surprises During Negotiations: When buyers discover issues during their own inspection, it can lead to last-minute negotiations, price reductions, or even a deal falling through. A pre-listing inspection gives you a chance to spot and address any problems ahead of time, so they don’t turn into last-minute headaches or negotiation roadblocks.

- Sell Your House Faster: According to Rocket Mortgage, if your house is listed in the best shape possible, there won’t be as many reasons for buyers to ask for concessions. That means you should be able to cut down on negotiation timelines and ultimately sell faster.

How Your Agent Will Help

But before you think about reaching out to any inspectors to get something scheduled, be sure to talk to an agent. Your agent will be able to give you advice on whether a pre-inspection is worthwhile for your house and the local market. Because it may not be as important if sellers still have the majority of the negotiation power where you live.

If your agent does recommend moving forward and getting one done, here’s how they’ll support you throughout the process.

- Offer Advice on How To Prioritize Repairs: If the inspection uncovers problems, your agent will sit down with you and offer perspective on what’s going to be a sticking point for buyers so you know what to prioritize.

- Knowledge of How To Handle Any Disclosure Requirements: After talking to your agent, you may decide not all of the repairs are worth it right now. Just be ready to disclose what you’re not tackling. Some states require disclosures as a part of a listing – lean on your agent for more information.

Bottom Line

While they’re definitely not required, pre-listing inspections can be especially helpful in today’s market. By understanding your home’s condition ahead of time, you can take control of the process and make informed decisions about what to fix before you list and what to disclose.

If you choose to skip this step, you may be just as surprised as your buyer by what pops up in their inspection. And that could leave you scrambling. Would you rather fix issues now or risk trying to save the deal later?

Let’s connect so you can see if this is a step that makes sense in our market.

More Buyers Are Making Moves – Is It Time To Sell?

More Buyers Are Making Moves — Is It Time To Sell?

BLOGMarch 4, 2025

2 min read

More people are taking steps to buy a home. And, if you’ve been waiting for the right time to move, this may be the sign you’ve been looking for.

For the past few years, a lot of would-be homebuyers hit pause on their plans. With rising mortgage rates and affordability challenges, buying just didn’t seem doable. But now, more of them are getting back out there. That’s because they’re getting used to the fact that this may be the new normal for the market – especially as forecasts show mortgage rates may be starting to stabilize. According to the National Association of Realtors (NAR):

“Home buyers seem to be getting over the shock of mortgage rates in the mid- to upper-6% range.”

And that’s good for you and your plans to sell. While there isn’t going to be a big rush of buyers flooding the market all at once, this does mean motivated buyers are re-starting their searches. And here’s the data to prove it.

3 Signs Buyers Are Ready To Make Their Move

1. Mortgage Applications Are on the Rise: According to the Mortgage Bankers Association (MBA), mortgage applications are up 37% since the start of the year. That’s a big jump and a clear sign more buyers are more active lately. Don’t miss out on that. Serious buyers who are getting their finances in order are great potential buyers for your house.

2. Buyer Demand Is Picking Up: The Homebuyer Demand Index from Redfin shows demand is up 3% since late January. While that’s not a huge spike, momentum is building.

3. More Home Showings: ShowingTime data says home showings are up 13% since the beginning of the year. This added foot traffic is exactly what you want to see if you’re about to sell your house. It signals more serious interest in buying. More buyers out there looking means more potential eyes on your house. And more eyes could translate to more offers.

And chances are, this activity is only going to pick up from here. We’re headed into the busiest season of the year for housing. Spring is when more people choose to buy or sell than any other time of year. So, now is a great time to list and get in on the action.

Bottom Line

As buyers re-enter the market, you have the chance to do the same thing. And the increase in buyer activity is definitely something you’ll want to take advantage of. To make sure your house gets in front of these motivated buyers, let’s connect.

If the right buyer walked through your door tomorrow, would you be ready to sell?

Is a Newly Built Home Right for You? The Pros and Cons

Is a Newly Built Home Right for You? The Pros and Cons

BLOGMarch 3, 2025

For BuyersNew ConstructionBuying Tips

3 min read

When searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible benefits. Talking to your agent is the best way to see if this type of home makes sense for you.

Here’s a quick rundown of some things your agent will walk you through – including a few of the top perks of buying a newly built home today and some potential things you’ll want to think about before you ink any contracts.

The Perks of Buying a Newly Built Home

Customization Options: Many builders allow buyers to choose finishes, layouts, and upgrades so that you can personalize your home to your unique sense of style. This is obviously more of a draw if the home is still under construction, but sometimes you can have a builder agree to some tweaks even after it’s completed.

Less Maintenance and Fewer Repairs: Everything from the roof to the appliances is brand new, which should save you on any upfront maintenance or repair costs — for at least the first few years. Many builders also offer warranties on things like structural components and major systems, to give you extra peace of mind. And not having to worry about this sort of thing is a big perk when everything feels so expensive right now.

Eco-Friendly and Energy-Efficient Features: With stricter building codes, newly built homes tend to be more environmentally friendly. This can include energy-efficient upgrades like smart thermostats and high-efficiency HVAC systems or eco-friendly tech. And all of these features can save you money on your future energy bills – again a welcome relief while inflation is stubbornly high.

Builder Incentives: Some builders are also offering incentives to homebuyers. While this will vary by builder, it could include rate buy-downs or other ways to offset today’s affordability challenges. As Bankrate says:

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.”

Other Considerations When Buying a Newly Built Home

On the other side of the coin, there are some things that you’ll want to at least consider before making your choice.

Longer Timelines: If you’re purchasing a home that’s still under construction, you may have to wait several months — or longer — before you can move in. As Realtor.com puts it:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

Potential Price Changes: Keep an eye on costs, too. It’s easy to go over budget if you keep tacking on upgrades or add-ons as you customize your build. At the same time, building materials, like lumber, can be affected by the economy, inflation, and changing trade policies. And unfortunately, if the cost of supplies climbs, builders will pass at least some of that increase on to people like you. As HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Bottom Line

New builds can be a great choice today, but you want to be sure you have all the information you need to make an informed decision on such a big purchase. That’s where my expertise and experience is extra important.

Would you consider a newly built home? Why or why not?